Manage contractual risks in one central platform

Trusted by over 10000 happy users

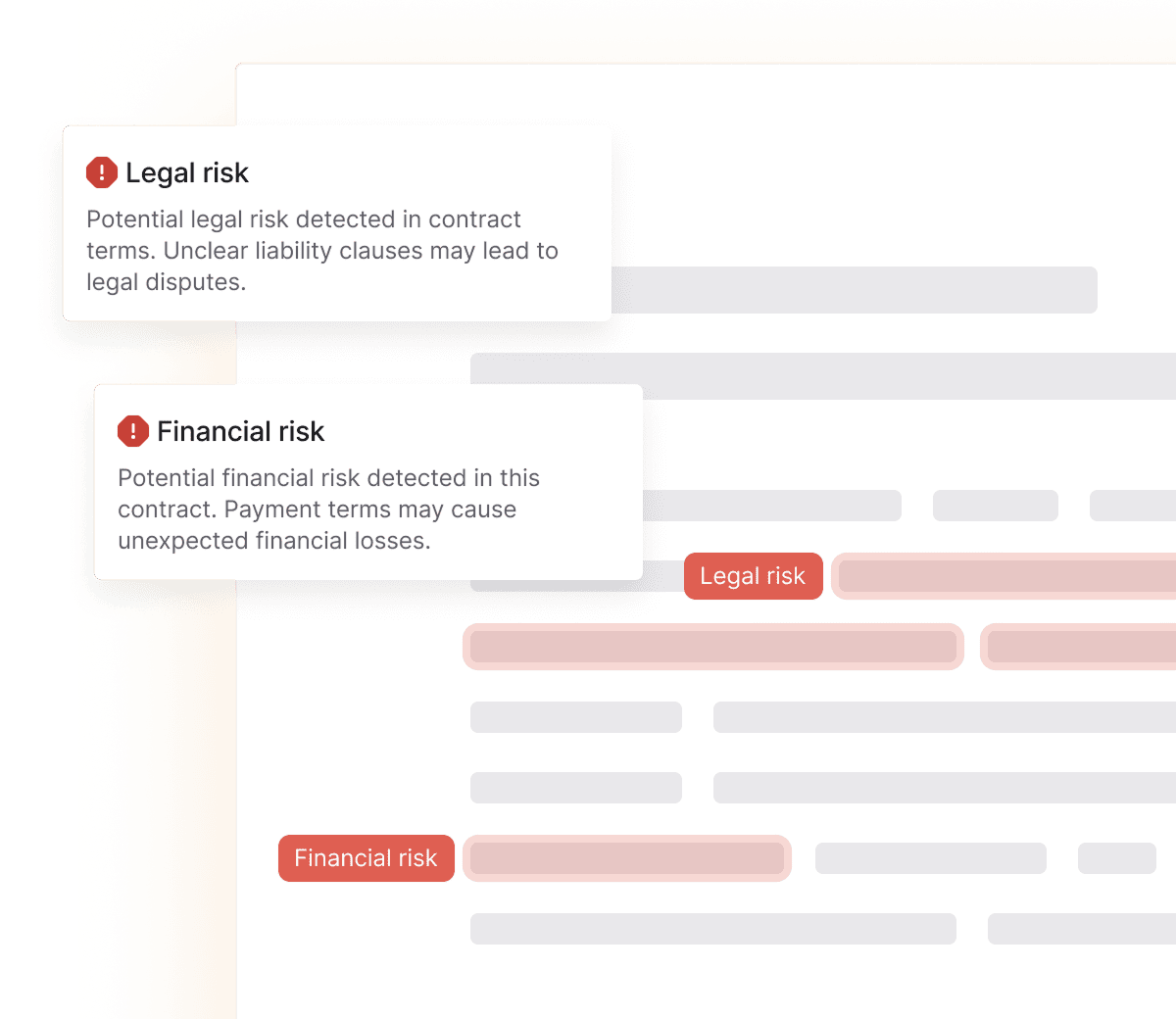

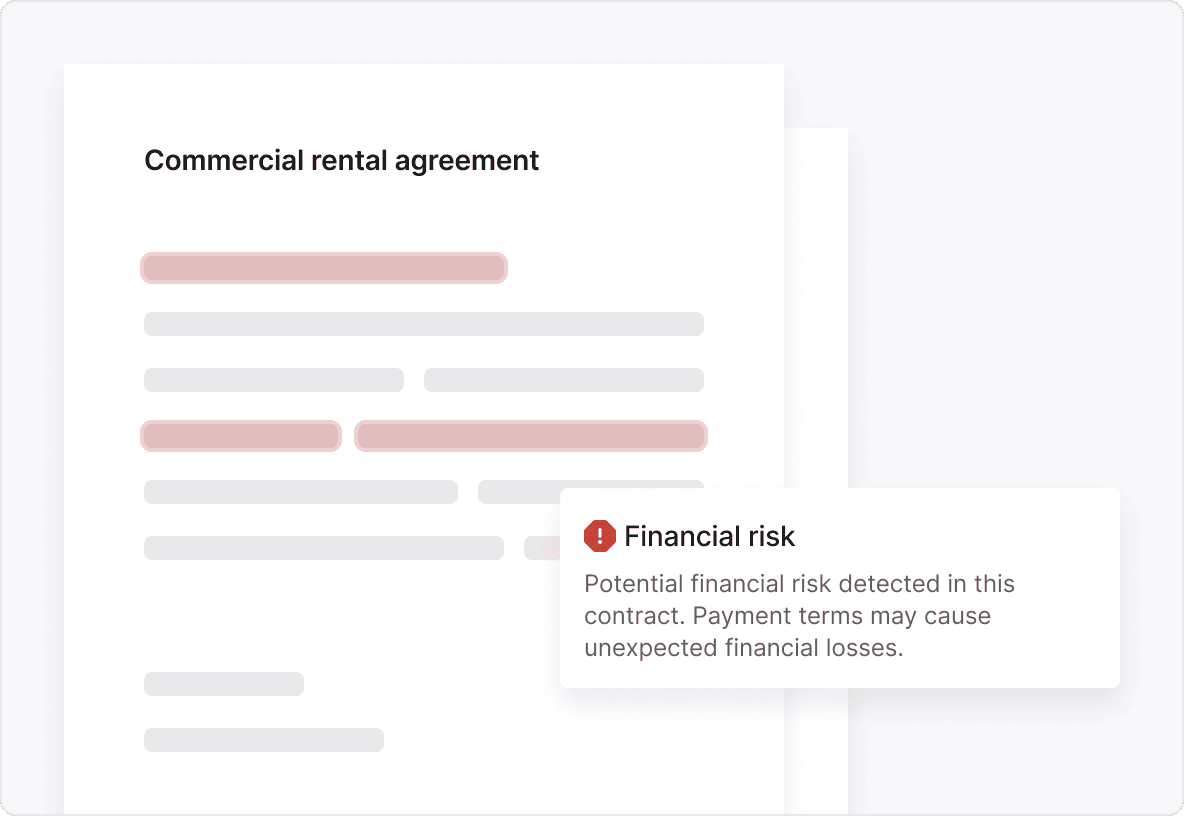

Centralized visibility of risk-relevant contract data

Structured risk assessment within contract workflows

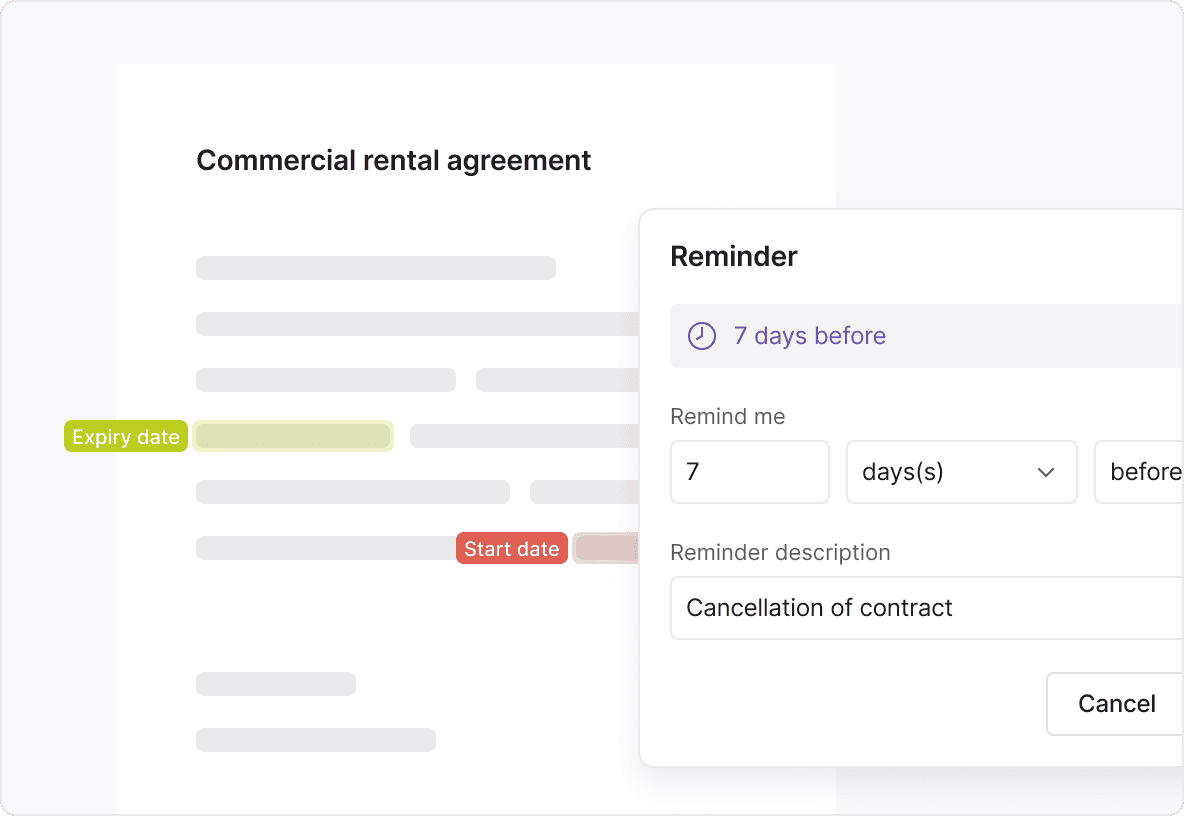

Reliable tracking of risk-critical deadlines and obligations

Built for consistent risk management across contracts

Award winning CLM software

FAQ

Contract management for risk management focuses on identifying, monitoring, and controlling risks that arise from contractual obligations, clauses, and deadlines. These risks include liability clauses, penalties, termination rights, compliance requirements, and contractual dependencies that can expose an organization to legal or financial consequences.

In many organizations, such risk-relevant information is buried in documents and spread across departments. Inhubber addresses this by centralizing contract data and making risk-relevant elements visible and traceable. Instead of reacting when issues arise, teams gain a proactive approach to managing contractual risk throughout the entire contract lifecycle.

Contractual risk is difficult to identify because contracts are typically managed in silos. Legal, procurement, compliance, and management often work with different documents, versions, or systems. Risk-critical clauses are reviewed once during negotiations and then forgotten during execution.

Without a centralized system, organizations lack a holistic view of risk exposure across contracts. Inhubber solves this by consolidating contracts into one platform, enabling structured access and ongoing visibility. This allows risks to be monitored continuously instead of only during isolated review phases.

Inhubber centralizes contracts in structured workspaces, allowing organizations to organize agreements by type, risk category, or responsibility. Risk-relevant information such as clauses, obligations, and deadlines becomes accessible in one place instead of scattered across files and emails.

This centralization creates a single source of truth. Teams no longer depend on individual knowledge or manual searches to understand exposure. With Inhubber, contract data becomes a reliable foundation for consistent risk management and informed decision-making.

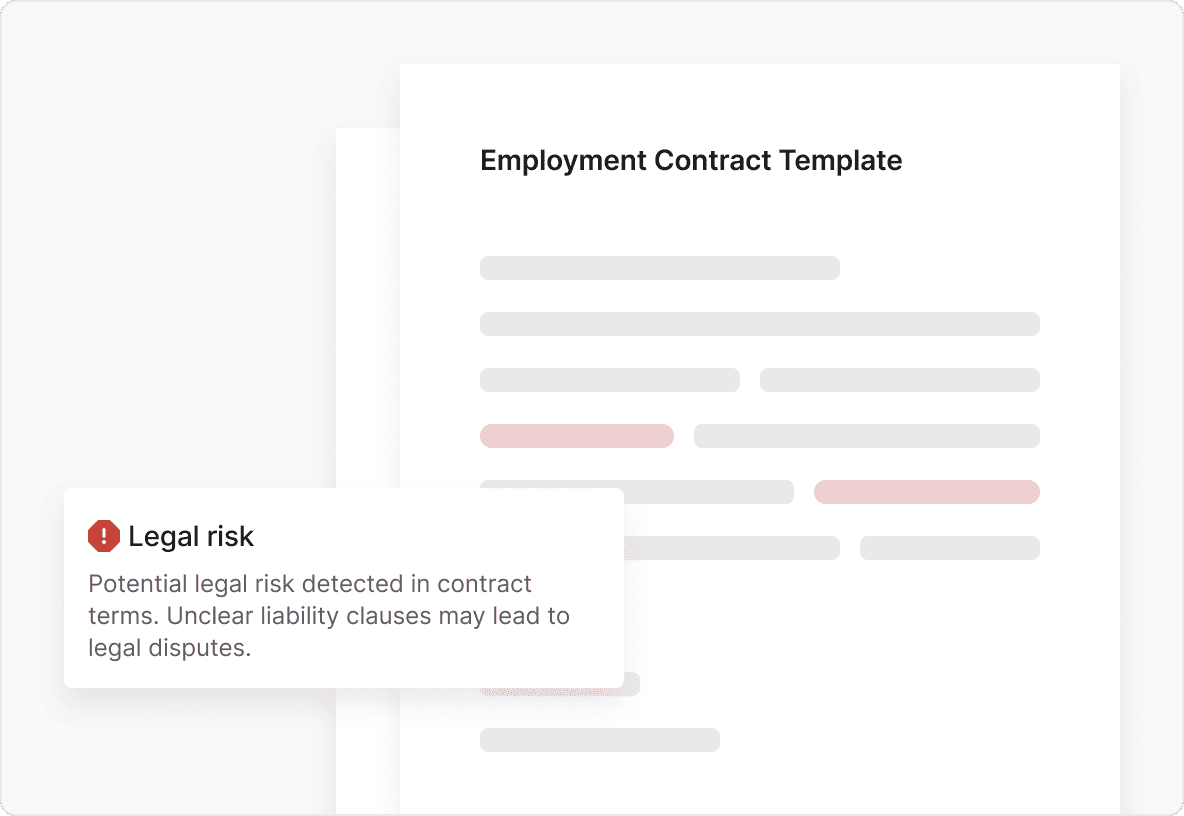

Risk assessment is often informal and inconsistent, relying on individual expertise rather than standardized criteria. Inhubber integrates risk assessment into contract workflows by supporting structured reviews and approvals.

Contracts can be reviewed using defined steps, ensuring that risk considerations are addressed before signing, renewal, or amendment. This approach improves consistency and reduces blind spots. Instead of ad-hoc decisions, organizations establish repeatable processes that embed risk management directly into contract handling.

Missed deadlines such as termination dates, renewals, or compliance obligations are a major source of contractual risk. They can lead to unwanted extensions, penalties, or legal exposure.

Inhubber tracks all risk-critical deadlines centrally and sends automated reminders ahead of time. This ensures that teams can review contracts and take action proactively. Deadline management shifts risk handling from reactive to preventive, helping organizations maintain control over contractual obligations.

Audits often require clear evidence of how risks were identified, reviewed, and approved. Without proper documentation, preparing for audits becomes time-consuming and disruptive.

Inhubber maintains audit-ready documentation by recording contract changes, approvals, and access rights. All actions are traceable, enabling internal and external reviewers to understand decisions without manual reconstruction. This reduces audit effort and increases confidence in governance processes.

In many organizations, contractual risk knowledge resides with a few experienced individuals. This creates vulnerability when those individuals are unavailable or leave the organization.

Inhubber transforms individual knowledge into shared organizational knowledge by documenting risk-related decisions and contract history centrally. Authorized teams can access the same information, ensuring continuity and reducing dependency on individuals. This strengthens organizational resilience and consistency.

Inhubber is designed to complement existing risk and compliance frameworks rather than replace them. It integrates contract data into established processes by providing structured access, documentation, and workflows.

This integration reduces duplication of effort and information gaps. Teams can continue working within familiar governance structures while using Inhubber as the central contract layer that supports risk oversight and reporting.

Contract management for risk management benefits legal, compliance, risk, and management teams alike. Legal teams gain structured oversight of risk clauses, compliance teams benefit from traceability, and management gains transparency into exposure and obligations.

By centralizing risk-relevant contract data, Inhubber enables collaboration across roles and supports informed decision-making at all levels of the organization.

Yes. Contractual risk exists in every industry, regardless of size or sector. Whether in manufacturing, services, technology, or finance, organizations rely on contracts that carry obligations and potential exposure.

Inhubber’s use case approach ensures that risk management capabilities apply across industries. The platform focuses on structure, transparency, and control rather than industry-specific features, making it adaptable to diverse organizational contexts.